ACCOUNTING

C specialty 071 "Accounting and taxation"

Specialization: "Accounting"

Branch of knowledge: 07 "Management and Administration"

Qualification:

junior specialist in accounting

Term of study (full-time and part-time)

On the basis of complete general secondary education - 2 years 10 months

Based on basic general secondary education - 3 years 10 months

Based on complete general secondary education and EQL "Skilled worker" - 1 year 5 months

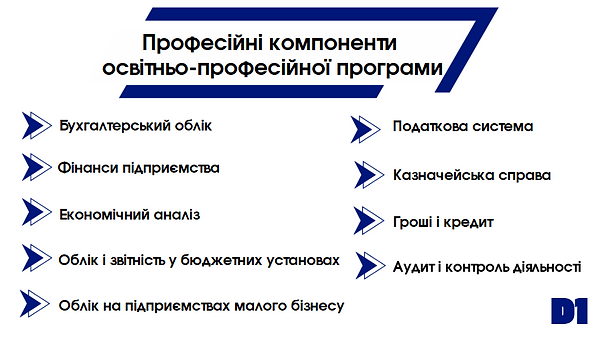

Special disciplines:

financial accounting, economic analysis, accounting and reporting in budgetary institutions, control and audit, tax system, treasury, finance, money and credit, information systems technology in accounting, accounting, pricing, etc.

Primary positions:

chief cashier, cashier, assistant accountant-expert, inspector with inventory, auditor.

Possible places for employment:

business accounting; accounting of organizations, institutions; banks; financial institutions (insurance companies, chambers of commerce and industry, etc.)

Specialty motto: Science, independence, trust!

Accounting is an art, a profession that requires talent and patience. It is a special gift to see in numbers the complex world of the economy in its interconnections and harmony. Specialization "Accounting" majoring in "Accounting and Taxation" is not only a popular economic specialty, but also a future activity for those who seek to reveal the secrets of the formation of economic information used to manage enterprises, organizations and institutions.

No company of any form of ownership today can do without the services of a highly qualified accounting specialist, because they are all required to keep financial statements, and all other types of reporting are based on it. The main task of the accountant - the use of available information, its analysis and interpretation. A qualified accountant must know the principles and methods of making business decisions in a market economy, to properly reflect them in accounting and reporting.

The specialty "Accounting has existed in the college since 1967. While studying in this specialty, students master the skills of studying the laws of development and management of tax processes, budgetary relations of the state in accordance with the laws and regulations of Ukraine; understanding the essence of tax risks; ability to exercise internal control and keep tax records; to develop directions of optimization and minimization of tax potential of enterprises of all forms of ownership, consulting in the field of taxation, etc ..

After college, graduates can continue their studies in a shortened program at a university of III-IV level of accreditation in any economic specialty.

|

|---|

|

|

|

|

|